Table of contents

- Understanding franchise fees, startup costs, and hidden expenses

- How much working capital you need and why it matters

- Comparing franchise costs by restaurant type

- Financing your franchise: options and smart strategies

- How technology like Otter reduces franchise costs and boosts efficiency

- Conclusion: Your Path to Franchise Success

The dream of owning one of the best restaurant franchises is compelling – instant brand recognition, proven business systems, and a roadmap to success. But here's the reality: the franchise cost list extends far beyond that initial franchise fee, and many aspiring entrepreneurs underestimate what the costs associated with operating a franchise are.

The true investment to open franchise restaurants ranges from $50,000 to over $6 million depending on the brand, location, and concept (1). This includes everything from franchise fees for equipment costs to working capital, plus those unexpected expenses that can derail unprepared restaurant owners.

This comprehensive guide breaks down every major cost category you'll encounter when buying a restaurant franchise, from upfront costs to ongoing operational expenses. You'll discover the hidden costs that catch many new franchise owners off guard, plus practical strategies for controlling expenses and maximizing profitability. We'll also explore how smart management systems can streamline operations and optimize investment costs once your new restaurant opens.

By the end, not only will you have a complete understanding of how much it costs to franchise a restaurant, you’ll feel confident making informed financial decisions about your franchise opportunities.

How much working capital you need and why it matters

Working capital—the money available to cover daily operations after opening day—is your financial lifeline. This includes everything from payroll and rent to inventory, utilities, and those unexpected expenses that every restaurant business encounters.

Here's a sobering reality: many franchise restaurants fail not because of poor sales or bad locations, but because franchise owners underestimate how much working capital they need to bridge the gap between launch and profitability. Without adequate cash reserves, even the most promising restaurants can find themselves unable to pay bills, forcing owners to dip into personal savings or scramble for emergency loans.

The 6-12 Month Safety Net Rule

Restaurant industry best practice recommends reserving enough working capital to cover at least 6–12 months of operating expenses. This buffer allows you to weather slow periods, manage seasonal fluctuations, and handle unforeseen costs without compromising quality.

Think of working capital as your business insurance policy. Just as you wouldn't drive without car insurance, you shouldn't operate a franchise without adequate liquid assets available.

Working Capital by Restaurant Type

The amount you'll need varies significantly based on your franchise model and location. Here are realistic scenarios to help you estimate:

Fast Food Franchise Example: Consider a quick-service restaurant franchise in a suburban strip mall. With monthly rent around $8,000, staff wages of $15,000, food costs of $12,000, and other expenses totaling $10,000, you're looking at roughly $45,000 in monthly operating costs. Following the 6-12 month rule, you'd need $270,000-$540,000 in working capital, though many successful franchise owners find $300,000-$400,000 provides a comfortable cushion.

Full-Service Restaurant Example: Picture a casual dining franchise in a busy downtown area. Monthly rent might reach $20,000, labor costs could hit $35,000 with full wait staff, food and beverage costs around $25,000, plus utilities, insurance, and other expenses adding $15,000. With $95,000 in monthly costs, working capital needs would range from $570,000 to over $1 million depending on your market conditions and risk tolerance.

Estimating Your Working Capital Needs

Use this practical framework to calculate your specific requirements:

Fixed monthly costs:

- List all predictable expenses (rent, salaries, insurance, utilities)

- Include ongoing royalty and advertising fees to your franchisor

- Don't forget loan payments and professional services

Variable costs:

- Estimate inventory needs and food costs

- Budget for local marketing and promotional activities

- Account for supplies and maintenance

Market factors:

- Research seasonal fluctuations in your area

- Plan for slower initial months as you build a customer base

- Consider local competition and market saturation

Safety margins:

- Factor in initial inventory and pre-opening expenses

- Add contingency funds for unexpected repairs or emergencies

- Include a buffer for economic downturns

Final calculation:

- Multiply your total monthly operating costs by 6–12 months

- Add 10-20% buffer for peace of mind

- This becomes your working capital target

Why Working Capital Matters for Long-Term Success

Adequate working capital is more than a safety cushion. It positions your franchise business for growth. With sufficient cash reserves, you can focus on building customer relationships, refining operations, and identifying expansion opportunities rather than constantly worrying about next month's bills.

When you understand the true cost range for franchise restaurants, working capital often represents 20-30% of your total investment. But unlike equipment or build-out costs, working capital remains available to fuel your business growth rather than being locked into fixed assets.

Comparing franchise costs by restaurant type

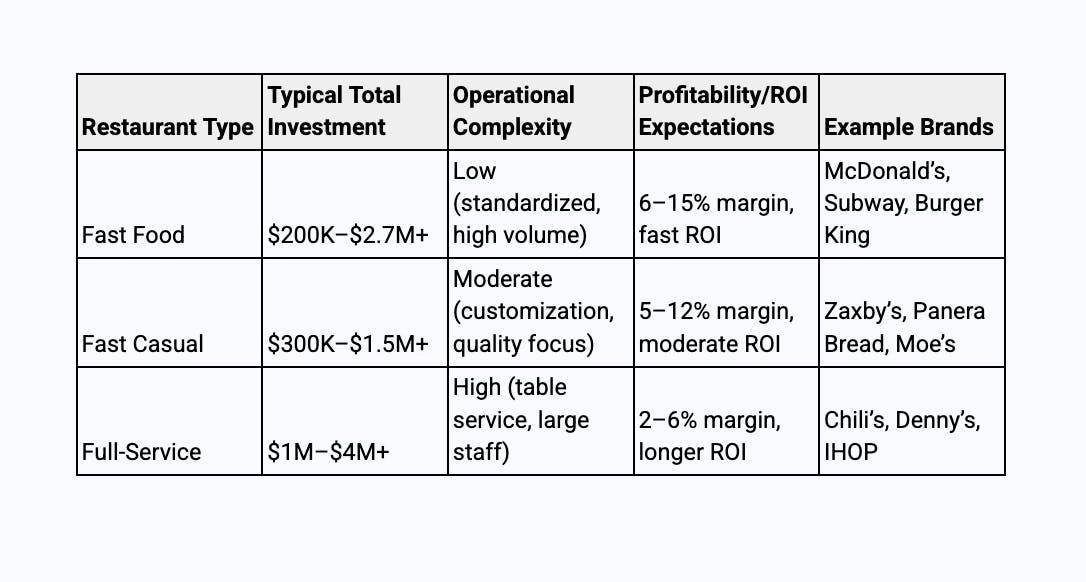

When researching the best restaurant franchises, understanding the differences in cost, operational demands, and profit potential between fast food, fast casual, and full-service models is crucial for making the right choice for your situation and financial requirements.

Fast Food Franchises: Speed and Simplicity

Fast food chains—including household names like McDonald's, Subway, Burger King, KFC, and Taco Bell—typically require total investments ranging from $200,000 to over $2.7 million (7), with location playing a large role in total cost.

The appeal lies in their straightforward operations. Fast food restaurants minimize operational demands through limited menu options, standardized preparation processes, and systems designed for speed. Labor requirements are generally lower, and staff training is more straightforward since most positions involve specific, repeatable tasks.

Profit margins for fast food chains generally range between 6% and 15%, with average annual gross sales per unit spanning from $750,000 to over $2 million for successful locations (8). The return on investment can be attractive due to lower labor costs, faster customer turnover, and proven business models.

Fast Casual Franchises: Quality Meets Efficiency

Fast casual concepts—such as Zaxby's, Panera Bread, Moe's Southwest Grill, and Chipotle—typically fall in the $300,000 to $1.5 million range for initial investment (9), though premium brands can reach higher. These restaurants occupy the middle ground between fast food convenience and full-service quality.

Fast casual operations offer higher-quality ingredients and more customization than traditional fast food restaurants, resulting in greater operational demands. Franchise owners must manage broader menus, more skilled kitchen staff, and create more inviting dining environments that encourage customers to linger.

While profit margins often mirror fast food ranges, fast casual brands frequently achieve higher average check sizes and appeal to health-conscious or experience-driven diners. This positioning allows for premium pricing that can offset higher ingredient and labor costs.

Full-Service Restaurant Franchises: Traditional Dining Experience

Full-service restaurant franchises—like Chili's, Denny's, IHOP, and Applebee's—require the largest investment, often between $1 million and $4 million or more (10). These operations represent the most demanding restaurant model, with table service, extensive menus, and a larger, well-trained staff.

The operational demands extend beyond just service style. Full-service restaurants need larger spaces, more equipment, extensive front-of-house and back-of-house staff, and sophisticated inventory management. They also require managers capable of coordinating multiple service areas simultaneously.

Full-service restaurants generally operate with thinner profit margins and longer ROI timelines, but can generate higher total sales volumes when well-managed and located in high-traffic areas.

Side-by-Side Comparison

Choosing Your Path

Understanding these differences helps entrepreneurs identify the best food franchises to own based on their budget, management experience, and long-term goals. Fast food chains offer speed and operational simplicity, fast casual balances quality with efficiency, and full-service provides traditional dining experiences with higher operational demands and investment requirements.

Your choice should align with both your available capital and your comfort level with operational demands. Consider not just the upfront investment, but also your experience managing teams, your local market preferences, and your personal involvement level in day-to-day restaurant operations.

Financing your franchise: options and smart strategies

Securing the right financing is often the bridge between dreaming about owning one of the best restaurant franchises and actually making it happen. The good news? You have several practical financing options, each designed to help entrepreneurs access the capital needed for franchise success.

Understanding Financial Requirements

Before exploring financing options, it's important to understand what franchisors typically require. Most established brands have minimum net worth requirements and expect franchisees to have sufficient liquid assets available. These financial requirements ensure you can sustain operations during the critical early months.

Typical financial requirements:

- Minimum net worth: Often 2-3 times the total investment

- Liquid assets: Usually 40-60% of total investment readily available

- Net worth requirement: Varies by brand, from $150,000 to $1.5 million+

SBA 7(a) Loans: The Gold Standard

SBA 7(a) loans represent one of the most attractive financing options for franchise restaurants, offering competitive interest rates and extended repayment terms. These government-backed loans provide flexibility—funds can cover real estate purchases, equipment, working capital, and other startup expenses.

The application process requires thorough documentation, and lenders evaluate several key factors: a comprehensive business plan, strong personal credit history, and relevant industry or management experience. While the approval process takes time, the favorable terms often make it worthwhile for serious franchise investors.

Franchise-Specific Lenders: Industry Expertise Matters

Many banks and financial institutions specialize in franchise financing, often maintaining relationships directly with franchisors or preferred lender networks. These specialists understand the franchise business model's unique advantages and can streamline the approval process.

Franchise-specific lenders bring valuable expertise to the table. They're familiar with brand performance data, understand typical franchise cash flows, and can often provide more flexible terms than traditional commercial lenders who may view franchise opportunities as higher-risk investments.

Personal Savings: Full Control, Full Ownership

Using personal savings offers distinct advantages, like zero debt obligations, complete ownership from day one, and freedom from lender requirements or restrictions. However, smart entrepreneurs maintain adequate personal emergency funds rather than investing every available dollar.

The key is striking the right balance. While self-funding provides maximum control, it also concentrates your financial risk. Consider keeping 6-12 months of personal expenses separate from your franchise investment to maintain financial security.

Investors and Partnerships: Shared Risk, Shared Rewards

Bringing in outside investors or forming partnerships can provide the substantial capital needed for larger franchise investments or multi-unit development deals. This approach works particularly well for entrepreneurs with strong operational experience but limited liquid assets.

Partnership structures vary widely. Some owners prefer to work with silent investors seeking passive returns, others with active partners who contribute both capital and expertise. The key is clearly defining roles, responsibilities, and profit-sharing arrangements before moving forward.

Home Equity Loans: Proceed with Caution

Home equity can provide access to significant capital at relatively attractive interest rates. However, this option requires careful consideration since your home serves as collateral for the loan.

If you're considering this route, ensure you have a realistic repayment plan and avoid borrowing against your home's full equity. Market fluctuations or restaurant business challenges could potentially put your primary residence at risk.

What Lenders Want to See

No matter which financing method you choose, be prepared to show the following criteria to lenders offering franchise financing applications:

Strong credit profile: Personal credit scores of 650+ are generally expected, with higher scores improving your terms and approval odds.

Comprehensive business plan: Detailed financial projections, market analysis, and operational plans demonstrate your preparedness and commitment to your own business.

Relevant experience: Management, business, or restaurant industry experience shows lenders you understand what it takes to operate successfully.

Adequate down payment: Most lenders require 20-30% down payment, demonstrating your financial commitment to the venture.

Franchise disclosure document (FDD) review: Lenders want to see you've thoroughly reviewed the FDD, which contains critical information about the franchisor's financial health, legal history, and franchise system performance.

Choosing the Right Financing Partner

Remember, financing a franchise is a normal part of the journey for most successful restaurant owners. Rather than seeing it as a barrier, view it as an opportunity to choose the right financial partner for your entrepreneurial journey.

The best financing strategy aligns with your long-term goals, risk tolerance, and growth plans. Some entrepreneurs prefer the security of SBA loans, while others value the speed and flexibility of franchise-specific lenders. Take time to compare terms, understand all fees and requirements, and choose lenders who demonstrate genuine interest in your success rather than just processing another loan application.

How technology like Otter reduces franchise costs and boosts efficiency

Technology is a game-changer for franchise restaurants, and platforms like Otter are at the forefront of helping franchise owners save money and operate more efficiently. By integrating operational technology into your restaurant business, you can significantly reduce labor costs through self-serve ordering options like kiosks and online ordering.

Otter's POS system, for example, offers industry-leading low processing fees (2.39% + 15¢ per transaction), helping you cut payment costs while giving guests the flexibility to order how they want. Franchise owners using Otter's kiosks have reported payroll savings of $3,000–$4,000 per month, plus an increase in average order value by up to 31% – proof that smart tech investments pay off quickly and improve your bottom line.

Streamlined Order Management Across All Channels

Order management is another area where Otter excels. Instead of juggling multiple tablets or systems, Otter's order management platform consolidates all your in-store, online, and third-party delivery orders into a single dashboard. This streamlines workflows, reduces errors, and ensures every order is tracked from start to finish.

For franchise businesses with multiple locations, Otter's centralized platform allows you to monitor performance, update menus, and manage promotions across all franchise locations in real time, making it easy to maintain brand consistency and quickly respond to market changes.

Simplified Communication and Labor Management

Communication and labor management become much more manageable with the right technology. Otter's tools help you, monitor operational health with live alerts, and automate routine tasks, freeing up your team to focus on guest experience instead of paperwork.

By reducing the number of separate tech tools you need, Otter lowers your overall technology overhead and provides a single platform to manage orders, payments, analytics, and more across your franchise operations.

Common Questions About Multi-Location Technology

How does Otter support multiple franchise locations? Otter's enterprise platform gives you a single source of truth for all your restaurants, making it easy to track gross sales, update menus, and benchmark performance across your entire franchise network. Everything is managed from one centralized dashboard.

How does Otter help improve franchise profitability? By automating order flow, reducing manual entry errors, and providing real-time analytics, Otter helps franchise businesses cut costs, minimize downtime, and capture more revenue, directly boosting your bottom line.

What makes Otter different from other restaurant technology? Unlike point solutions that only address one aspect of operations, Otter provides an integrated platform that handles everything from order management to performance analytics, reducing operational demands and costs for franchise owners.

The Bottom Line on Restaurant Technology

For franchise owners looking to maximize efficiency and profitability, choosing the right technology partner can make the difference between struggling with operational demands and scaling with confidence. Otter's all-in-one platform is designed to grow with your restaurant business, regardless of how many you’re running.

The key is finding technology that doesn't just add features, but actually simplifies your operations while improving your financial performance. When you can reduce labor costs, streamline order management, and gain real-time insights across all franchise locations from a single platform, you're investing in sustainable franchise success.

Conclusion: Your Path to Franchise Success

Opening a restaurant franchise represents one of the most exciting franchise opportunities in today's market. From quick-service restaurants like McDonald's and Subway to full-service establishments, the restaurant industry offers diverse paths for entrepreneurs ready to own their own business.

The key to success lies in understanding the complete financial picture, from the initial franchise fee and startup costs to ongoing fees and working capital requirements. Whether you're considering a fast food franchise in California or a full-service restaurant in New York, thorough financial planning and the right operational systems will set your franchise business up for long-term success.

The restaurant business may be challenging, but for prepared entrepreneurs who understand the investment costs and operational demands, franchise opportunities offer a proven path to business ownership and financial independence.

Book a demo with Otter

It’s time to enhance your operations with Otter’s all-in-one restaurant platform. Book time with our sales team to learn more.

Book a demo to see how Otter’s all-in-one platform can help your restaurant thrive.