Table of contents

- Online Food Delivery Profits May Not Be as They Seem: A Cautionary Tale & Guide

- Topic Outline

- Everyone Knows That a Restaurant’s Profits Grow When It Uses Online Food Delivery Platforms… Right?

- The Dark Side: When Increase in Sales ≠ Increase in Profits

- Delivery Reconciliation 101: Why does it matter so much?

- Why is Reconciliation So Tricky for Operators

- Where Your Delivery Revenues Go: Platform Fee Breakdown

- Commission Fees

- Order Adjustment Charges: The Silent Profit-Killers

- Additional Adjustment Types

- Marketing & Advertising Costs

- Rescuing Your Profits: How to Reduce Risk & Protect Margins

- How Market Leaders Choose the Right Reconciliation Partners

- Conclusion

Executive Summary

Online Food Delivery Profits May Not Be as They Seem: A Cautionary Tale & Guide

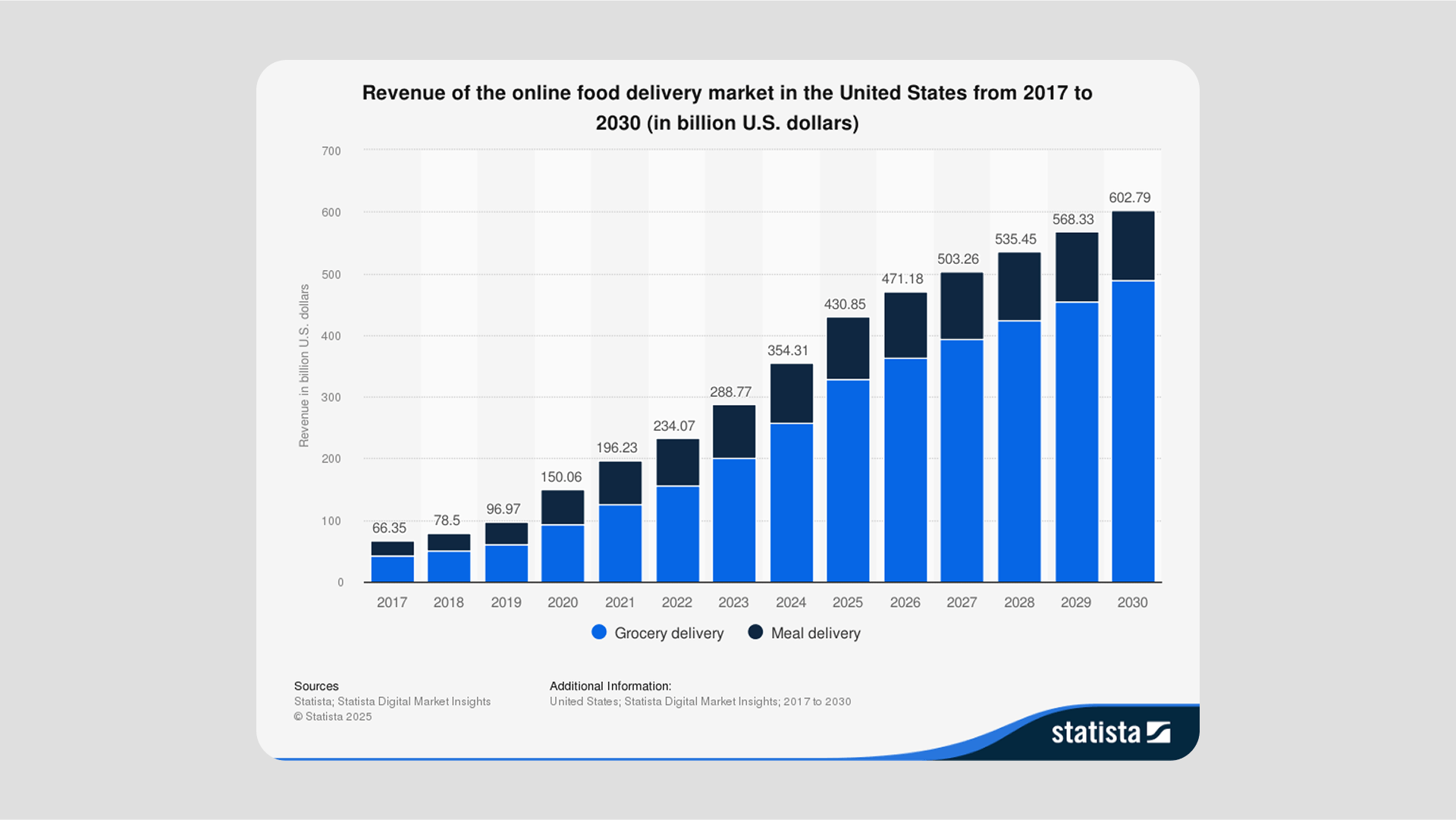

Numerous reports and publications tout the benefits of online delivery platforms and their positive impact on restaurants.

And yes, there are numerous advantages to online ordering via delivery Platforms. And yes, online ordering can boost a restaurant’s profits. Rarely discussed, however, is the full picture- the tight margins, hidden fees and adjustments that negatively impact a restaurant and its potential profitability downstream. Navigating today's delivery landscape and its associated costs can be surprisingly complex. Operators face an evolving world of omnichannel payments, shifting fee structures, refunds, cancellations, and volatile costs that can pose a challenge to true profitability. Many operators report that while top-line sales grow with delivery, the bottom line only grows if every fee and adjustment is tracked, and if menu/pricing is carefully managed for the channel– and delivery platforms don’t make it easy.

The Challenge

Delivery is growing quickly, but without integrated systems and clear reporting, it’s hard for restaurants to know if it’s truly profitable.

Incomplete reconciliation of fees and commissions can result in restaurants actually paying more in taxes and royalties than they actually earned in collectible revenue, further eroding take-home profit. (Otter Financial Reconciliation Primer)

Watch Out

5–15% of net sales can be at risk due to unaccounted-for fees and adjustments.

Industry data reveals that as much as 5–15% of net sales can be at risk due to untracked refunds, platform fees, and uncorrected adjustments at the point of financial reconciliation—an issue that's especially challenging for high-volume multi-unit operations. Without a clear and unified reconciliation process, restaurants risk overpaying sales tax and royalties, losing revenue to unclaimed refunds or fees, and getting bogged down in inefficient manual processes that drain valuable time and resources.

This comprehensive, U.S.-focused report sheds light on the key risks and challenges in delivery financial reconciliation today. It combines thorough market analysis with real-world data from over 220 million orders (derived from Otter’s 2024 aggregated internal data across major delivery partners) and actionable insights to help operators protect margins, simplify complex fee structures, and implement modern, automated workflows. These practices position leading brands to reclaim lost revenue, gain financial clarity, and stay competitive in today's delivery-driven marketplace.

By presenting the latest benchmarks, fee and adjustment breakdowns, and reconciliation best practices, this report delivers a practical playbook for restaurant owners and operators, and franchise executives ready to master delivery profitability in 2025 and beyond.

Topic Outline

1. Industry Overview: The State of U.S. Restaurant Finances in 2025

Overview of delivery market size and projected growth, forces impacting delivery growth, and margin pressures on quick-service, fast-casual, and multi-unit operations this year.

2. The Dark Side of Delivery: When Increase in Sales ≠ Increase in Profits

Overview of how digital sales growth often masks shrinking margins due to hidden fees, delayed adjustments, and reconciliation challenges, leaving operators at risk of overstating revenue and eroding profitability.

3. Delivery Reconciliation 101: What It Is and Why It Matters

Accessible explanation of financial reconciliation in delivery and the importance of proper reconciliation. Overview of consequences of unreconciled orders.

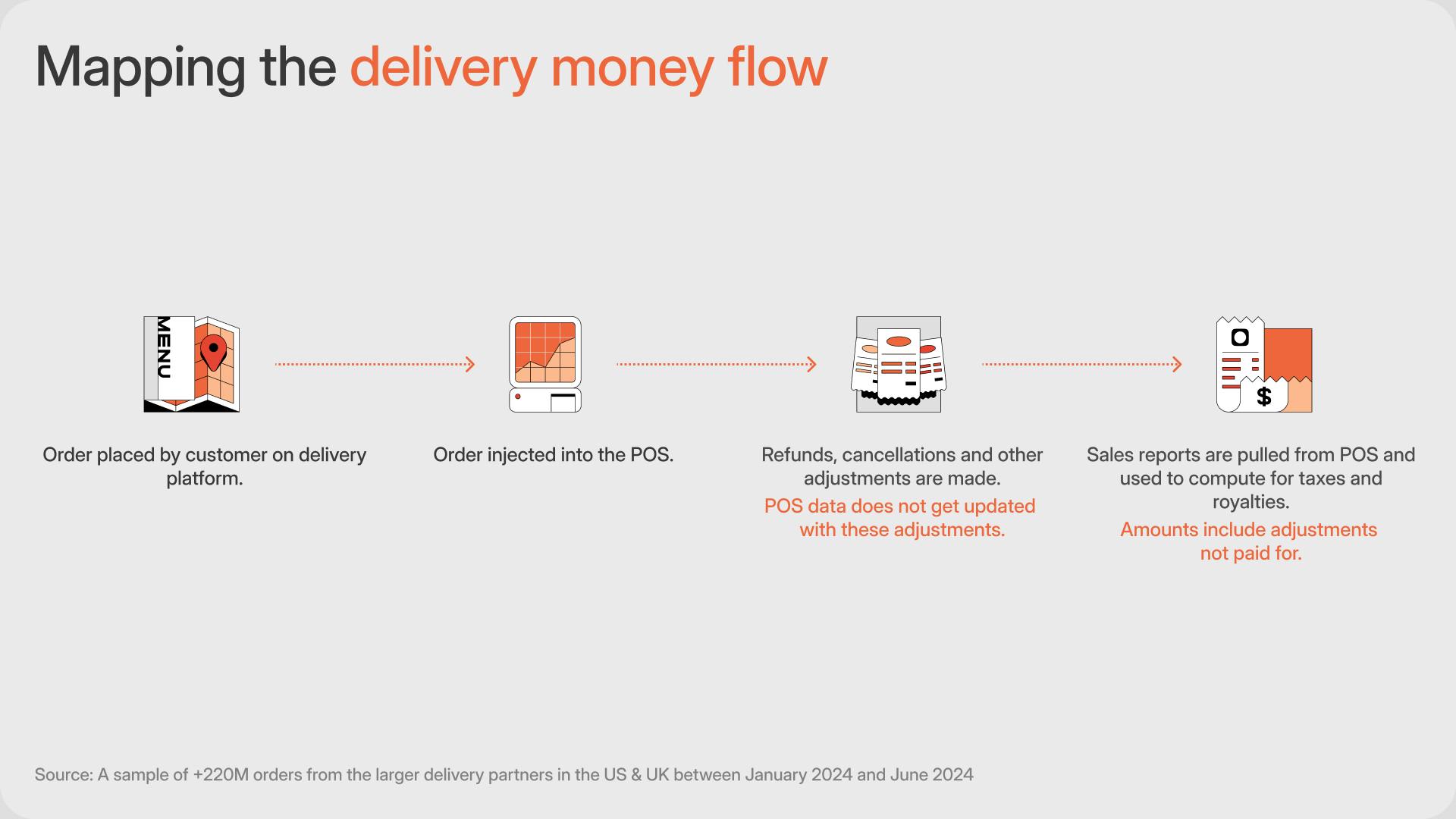

4. Mapping the Delivery Money Flow

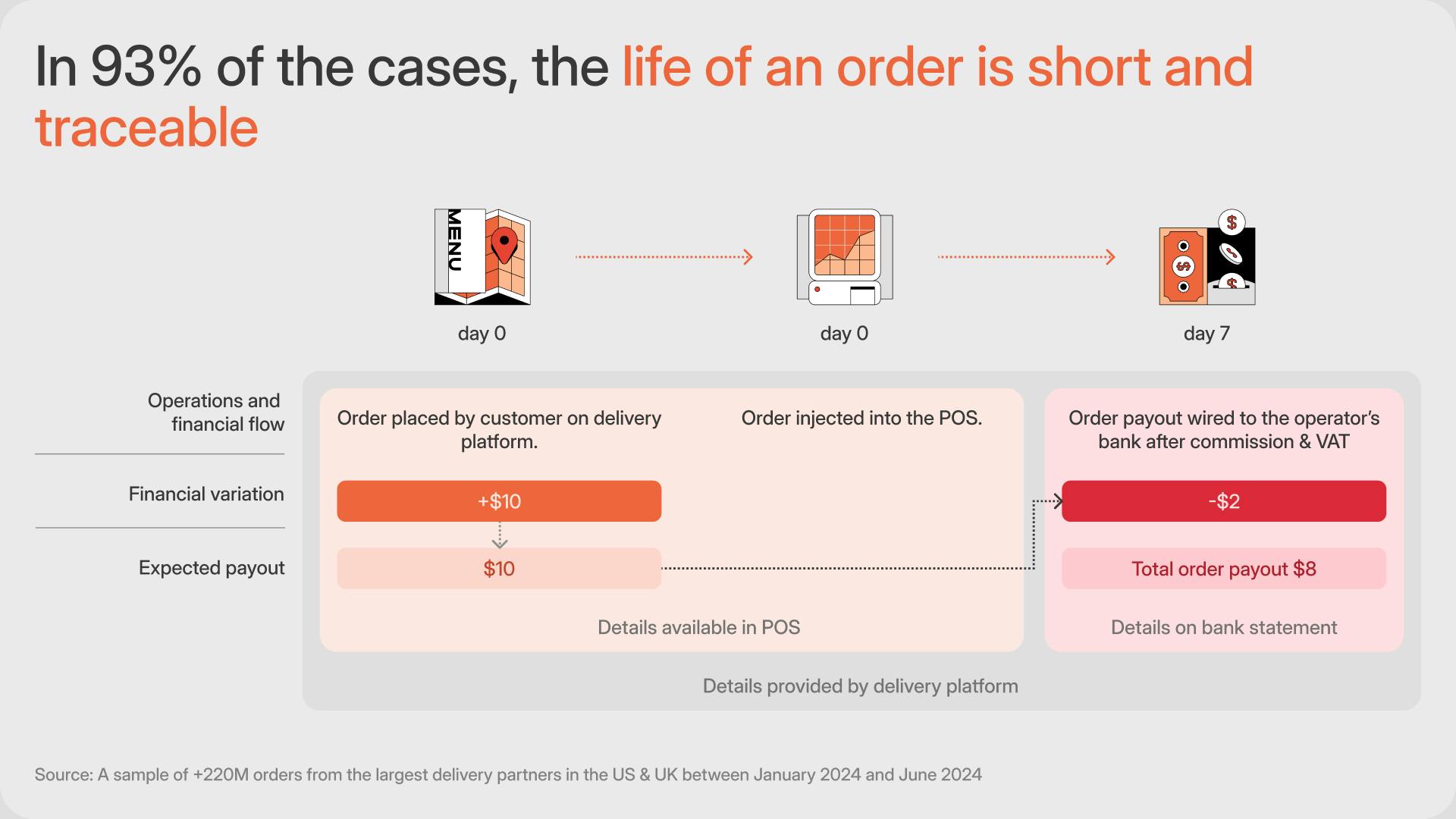

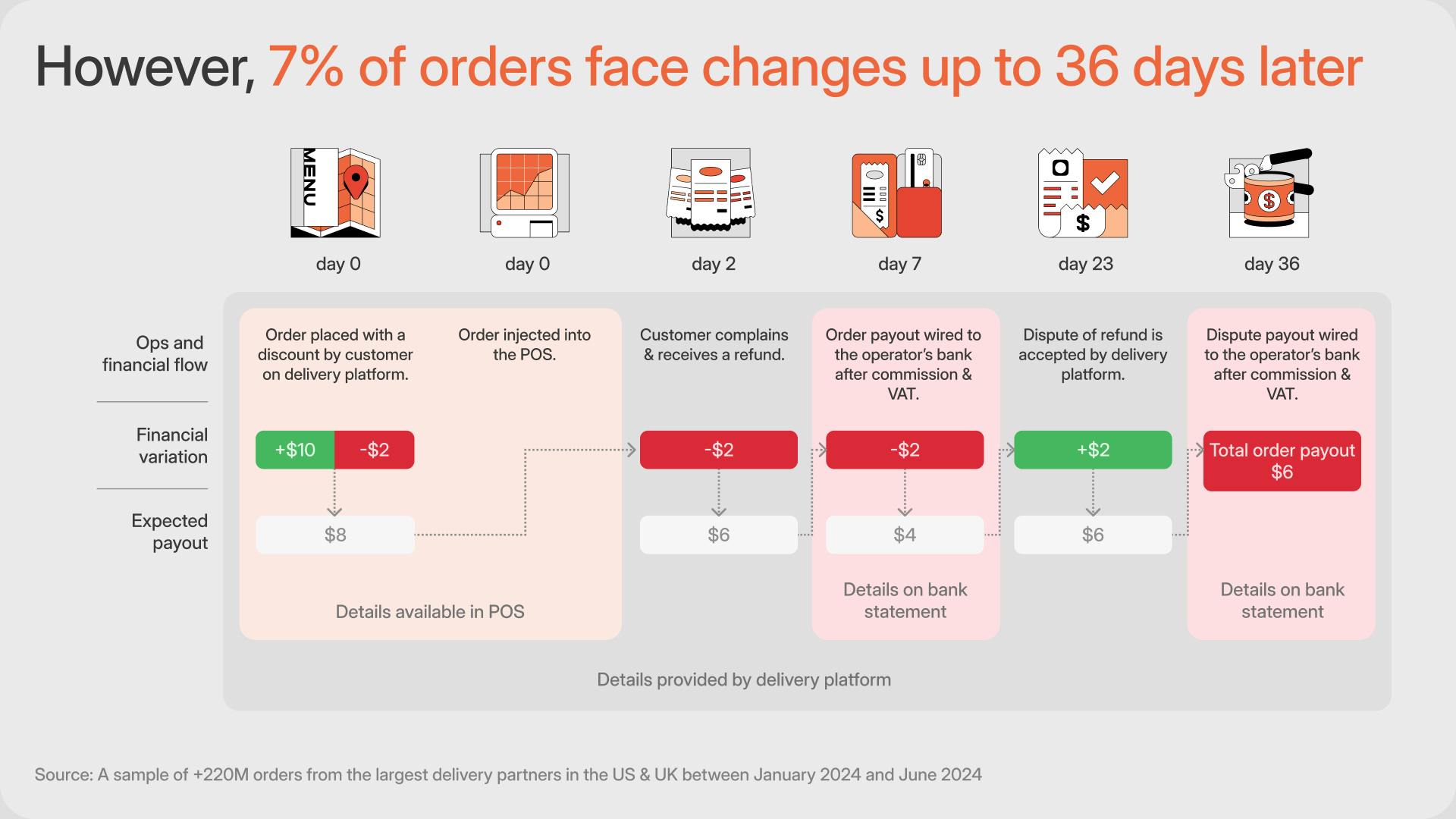

Step-by-step description of how an order moves from customer to platform, POS, payout, and bank, including typical timing and deviations (7%)

5. Reconciliation Pain Points

Discussion of challenges with fee nomenclature and reporting formats. Top obstacles operators face: data mismatches, adjustment timelines (delayed adjustments), hidden fees, missing order IDs, and manual reconciliation inefficiencies/lack of scalability.

6. Fee & Adjustment Breakdown: Understanding What Eats Into Your Earnings

Detailed breakdown (table) of common third-party fees, commission structures, common fee categories, and financial adjustments types (refunds, promotions, bag fees, error charges, marketing, disputed orders), and their impact on payout & profit.

7. Rescuing Your Profits: Solutions

Discussion of operational challenges. Comparing traditional spreadsheet-based methods to automated reconciliation technology & tools (demonstrating efficiency and accuracy gains).

8. Selecting the Right Reconciliation Partner

Best practices in choosing the right reconciliation partner. What market leaders look for to ensure efficiency, proper reporting, security and accuracy.

9. Conclusion

A summary of key points and recap of solutions discussed.

12. Appendix: Glossary, Data Highlights, and Resources

Any additional information such as definitions of key terms, sources, sample data illustrations, and references for further reading.

Industry Overview

Everyone Knows That a Restaurant’s Profits Grow When It Uses Online Food Delivery Platforms… Right?

Restaurant industry reports and news about food delivery platforms often highlight the upsides of third-party food delivery services like UberEats and Doordash. The stats include:

- The global online food delivery market is projected to reach $1.41 trillion in 2025 (Toast POS)

- Profits from takeout orders have increased by 15-30% for restaurants leveraging online ordering platforms [SOURCE]

- 78% of restaurant owners identify online ordering as their primary order-driving channel (Square's 2025 Future of Commerce report)

- Consumer spending averages 20% higher on online platforms compared to in-person orders (Deloitte)

The third-party food delivery space has indeed seen explosive growth, while reshaping how restaurants traditionally operate and earn revenue. On paper, the numbers paint a glowing picture– one that suggests that restaurants embracing these platforms have a golden ticket to growth and profitability. But those statistics only tell part of the story.

Caveats - Problem Statement

The Dark Side: When Increase in Sales ≠ Increase in Profits

Owner/Operator Perspective

78% of restaurant owners say digital orders drive their main sales, but many also admit they struggle reconciling payouts with their POS and bank records.

The glossy success story of online food delivery hides a tricky reality: orders only translate to profits if they stay on top of every fee, deduction, and adjustment that comes along with the sale. Those include chargebacks, cancellations, delayed refunds, bag fees, promotional deductions– the list is long and these adjustments can be difficult to track– especially when many of them can sometimes come as late as a month or more after the sale.

Beyond the buzz of exploding UberEats and DoorDash sales, are the hard-to-track costs, along with the added complexity and variability of each platform.

For high-volume restaurants or multi-location groups, these leaks add up quickly. And if you’re trying to track them manually? Nearly impossible.

Restaurants that miss accurately reconciling these adjustments into their bottom line revenue risk paying more in taxes and royalties than they actually collect because they overreport their revenue, without these fees subtracted.

These numbers show just how steep the drop can be:

- Margins can fall by as much as 64% compared to direct sales.

- For every $100 in direct sales, restaurants might keep $20–25 in profit. For the same $100 in third-party delivery sales, profit can shrink to just $7–9【A sample of +220M orders from the main delivery partners in the US & UK between 1st Jan 2024 and June 2024]

This is the dark side of delivery. It’s the operational complexity—hidden fees, delayed adjustments, and accounting headaches—that can quietly drain a restaurant’s take-home profit– and even result in negative margins on delivery orders if not caught downstream.

Delivery Reconciliation 101: Why does it matter so much?

Key Insight

Reconciliation is the difference between chasing sales and actually keeping profits.

Reconciliation is the process of making sure every fee, deduction, and adjustment taken out by delivery platforms is properly accounted for in your profit calculations and tax reporting. It’s not as simple as subtracting the 18–27% commission. Instead, it’s a mix of hidden deductions—refunds, chargebacks, cancellations, bag fees, promo costs—

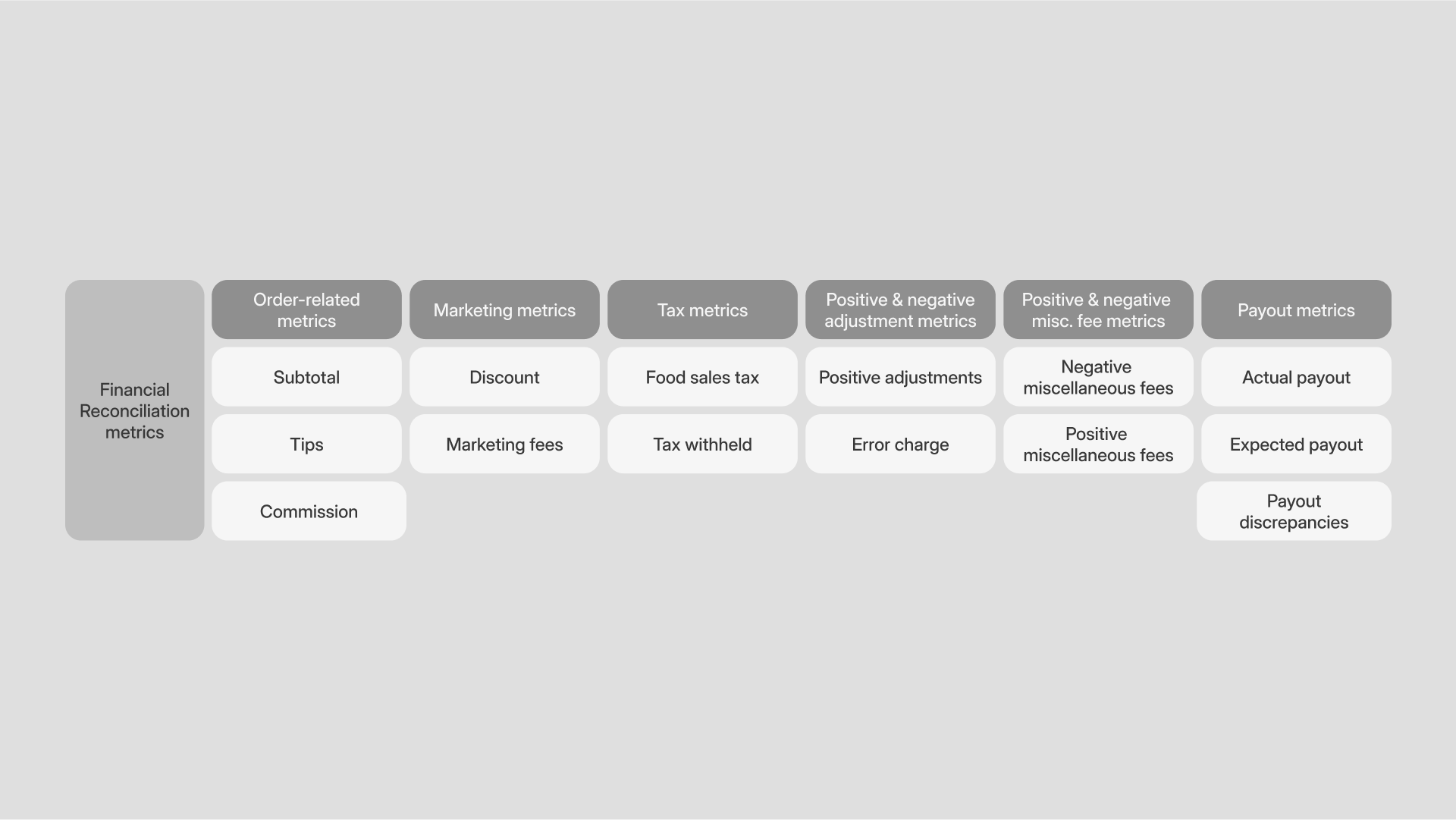

Delivery reconciliation specifically means matching and consolidating orders and payment flows across four key places:

- Your POS system

- The delivery platform reports

- Your bank deposits

- Your tax revenue reporting

Reconciliation isn't just for proper accounting and decision-making; it has a real impact on earnings because of royalties and taxes that are based on inaccurately inflated gross sales. Done right, reconciliation ensures accurate revenue recognition, proper tax and royalty payments, and timely resolution of discrepancies. Done poorly—or skipped—it chips away at profits.

Reconciliation Pain Points

Why is Reconciliation So Tricky for Operators

Pain Point Breakdown

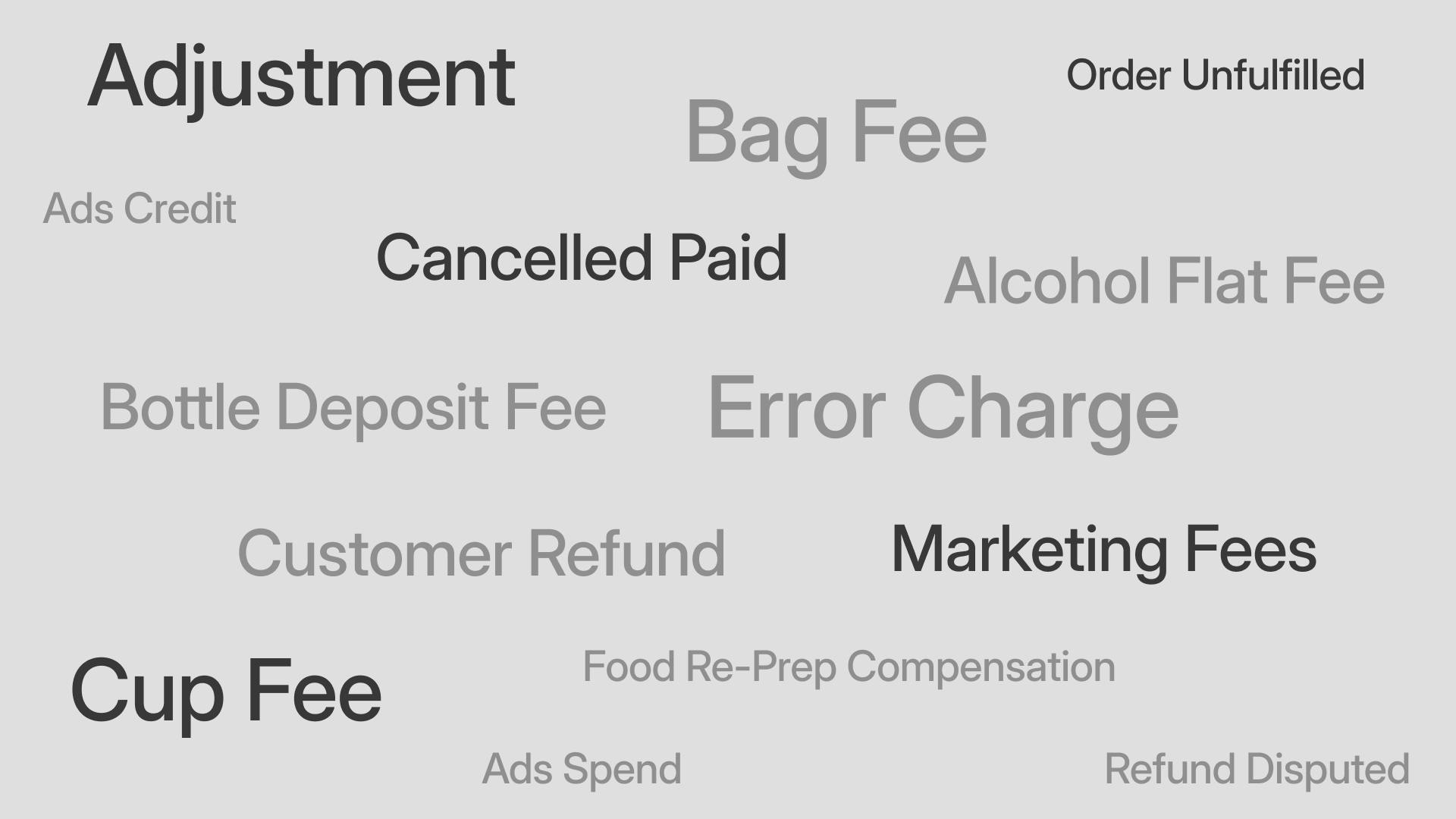

- Nomenclature: Every delivery platform labels fees/adjustments differently.

- Hidden Fees: Deductions are hard to trace in reports & dashboard

- Retroactive Changes: Adjustments can sometimes take weeks to show up

- Tech Limitations: Many POS systems don’t have the functionality to sync/track adjustments

- Mismatched Timing: Transaction & adjustment dates

- Scale: Volume of orders or multiple locations can be complex

- Manual processes require a significant workload and use of resources

Reconciling delivery sales and adjustments in the books isn’t a matter of simply deducting a flat commission. Operators face complex and constantly shifting fee structures– each adjustment with different rules and names depending on the platform. These make it difficult for both POS systems, tools and internal teams to track what is truly being earned– and deducted.

Delayed timing of adjustments adds another layer of difficulty. Discounts apply instantly at checkout, while refunds and chargebacks can appear weeks later—sometimes more than a month after the original transaction. This creates distortions in reported profits, especially since POS systems rarely sync with late adjustments. Recent data shows that post-sale adjustments can stealthily erode 5–15% of net sales. A $2 refund against a $10 order may never flow back into the books, leaving sales overstated when tax season comes around.

Key Insight

On average, about 7% of delivery orders undergo changes that the POS never accounts for.

Technology limitations further complicate the picture. Most restaurant POS systems do not automatically reconcile with delivery platform reports, leading to mismatched or missing data. Cancelled orders may still appear as completed, while adjustments downstream often go undetected. In practice, this means restaurants can end up overpaying taxes and fees, simply because their systems don’t reflect the true flow of funds.

Restaurant Perspective

“A customer of ours spent 4 days per month doing manual reconciliation.” -Louis Fossati, Otter Customer Operations Manager

All of this places a heavy burden on finance teams. Many restaurants spend several days each month manually combing through reports, cross-checking transactions, and correcting discrepancies. For larger operators—franchises, multi-unit groups, and multi-state brands—the risks multiply with volume. Thousands of weekly orders across different markets and platforms increase the likelihood of missed adjustments, delayed reconciliations, and inaccurate royalty or tax allocations. Studies show that especially at scale, operators can lose up to 5% of net sales to unresolved delivery errors and adjustments.

Not only is it near-impossible to keep track, reconciliation has also become a resource-intensive challenge shaped by evolving fees, delayed adjustments, fragmented systems, and scale pressures. Even with strong processes in place, operators risk not only losing meaningful revenue but also carrying overstated liabilities month after month.

Fee Breakdown

Where Your Delivery Revenues Go: Platform Fee Breakdown

Owner/Operators must be aware of the types of fees and adjustments their business(es) can be subject to-– often retroactively.

Fees, commissions, and payouts in third-party delivery marketplaces can be tough to keep track of without the proper support, and it can be particularly tricky to stay up to date on changes in fee structures. While several are constant and appear per transaction immediately (commission, taxes, product discounts), many can pop up weeks after a restaurant has already accounted for the order.

Commission Fees

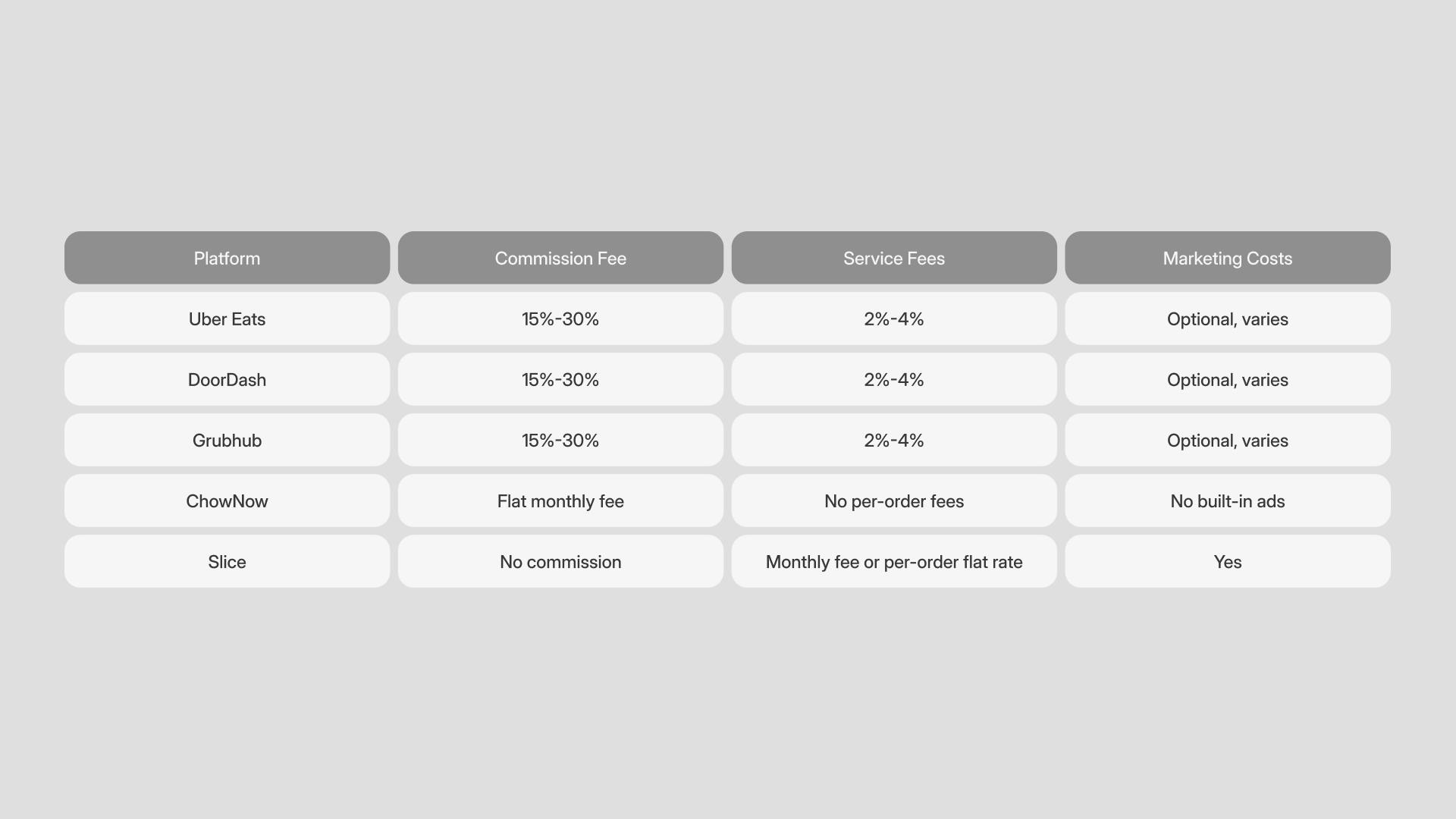

In March 2025, CloudKitchens broke down the types of commission fees and common rates per platform. These rates typically range from 15% to 30% of gross sales per order, depending on the platform and service level chosen by the restaurant.

- Standard Commission (15%-20%): Basic listing and order fulfillment.

- Premium Commission (25%-30%): Includes marketing boosts, featured placements, and priority in search results.

Some platforms, however, use tiered or dynamic commissions. For example, “DashPass” or “Eats Pass” programs may all increase a restaurant’s commission rate beyond base levels.

Order Adjustment Charges: The Silent Profit-Killers

Retroactive order adjustments are one of the most significant threats to profitability. These adjustments are automatically deducted from restaurant payouts, sometimes weeks after the order date, and often reflect reported problems with an order, such as missing or incorrect items, late deliveries (even including driver wait time for order pickup), customer quality complaints, wrong order delivery, and more. These can show up as full or partial refunds, fees, deductions or chargebacks from disputes.

These adjustments often occur without clear explanations or recourse options. Unclaimed refunds and cancellation fees represent another source of revenue battering, particularly when promotional discounts missed in reconciliation create discrepancies between what restaurants expect to receive and what actually reaches their accounts. Timing mismatches between platform payouts and POS systems further complicate accurate financial tracking.

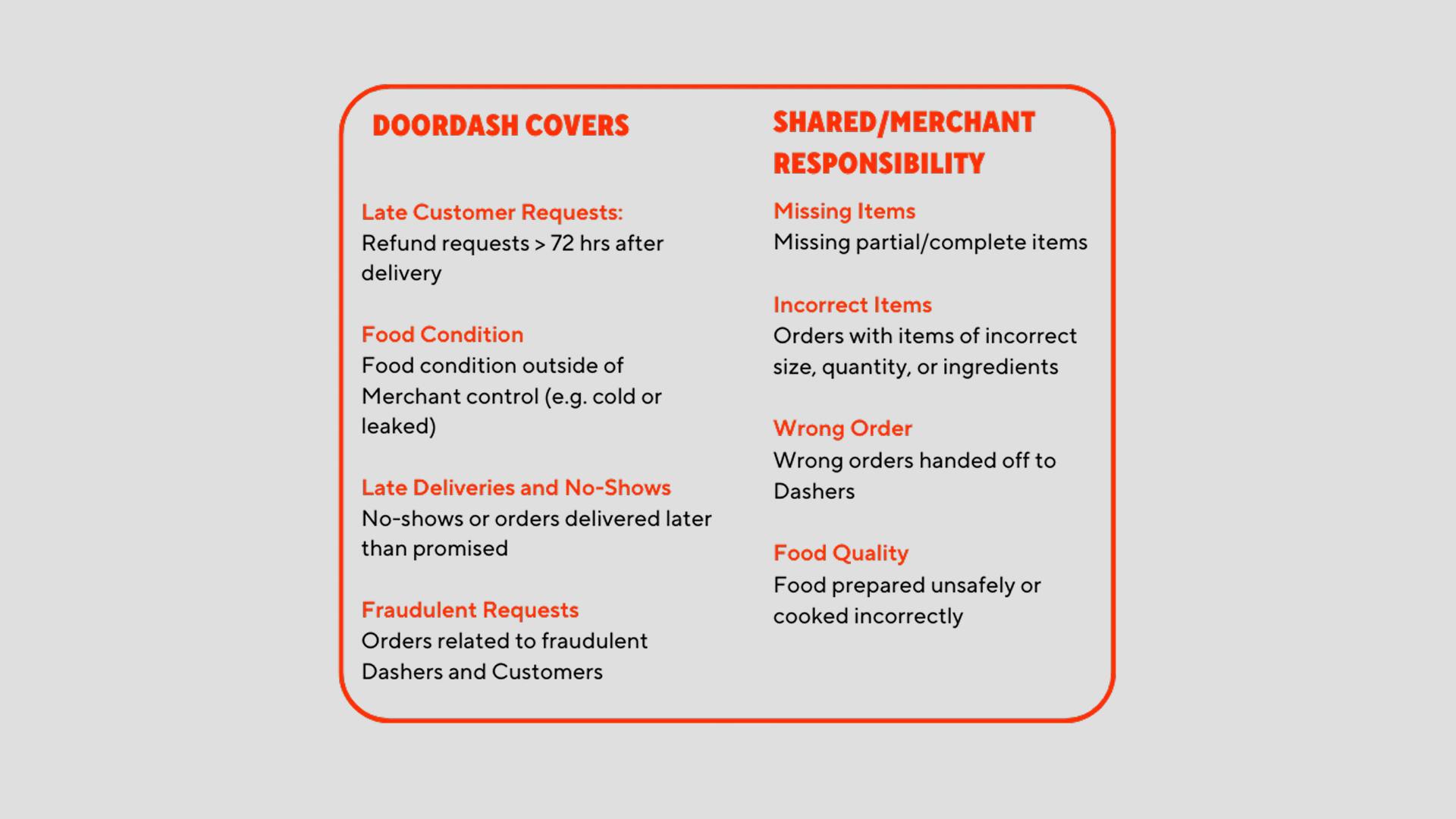

An example of Doordash’s Error Charge Policy.

Additional Adjustment Types

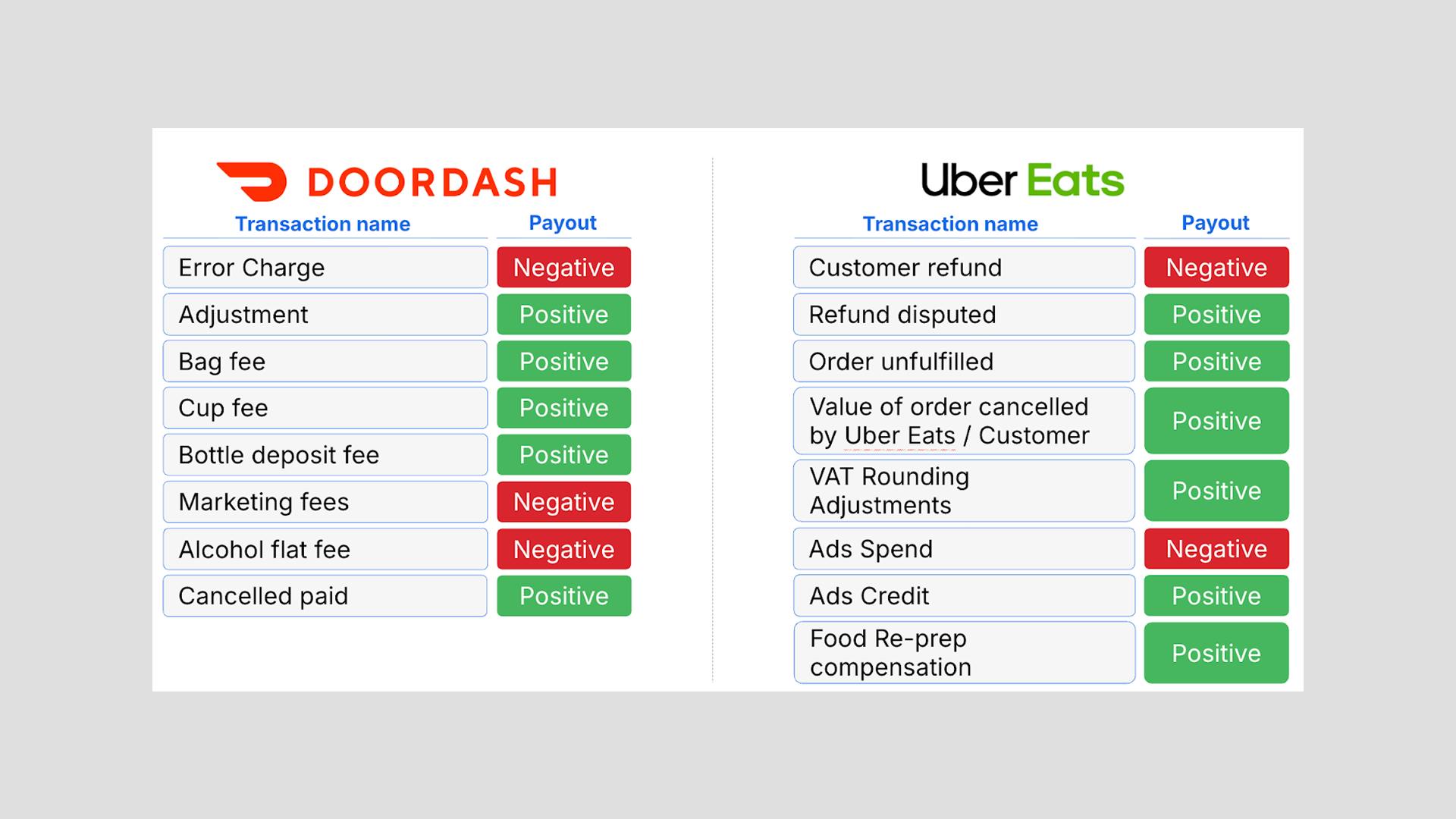

The tables below are examples of the different adjustment types impacting revenue– both positively and negatively.

Other, less common fees that have been reported range from technical adjustments from system glitches to penalty fees for issues with platform policy compliance. All of these small fees add up—often only appearing as line items on payout reports, not in the restaurant’s POS, which most restaurants consider their main source of truth.

Marketing & Advertising Costs

Recent analyses suggest that nearly 80–85% of U.S. restaurants have some form of presence on at least one third-party delivery app. Restaurants are now competing not only locally, with consumer access expanding further, creating crowded marketplace conditions. Online Platform Marketing has become more than just an optional approach, with most restaurants needing to participate in order to increase visibility in a crowded environment full of options for consumers. The cost of these campaigns is taken out of the restaurant’s payout, further shrinking net revenue per order—especially if promotions are aggressive or run frequently to compete in crowded delivery marketplaces.

Restaurants that want to stand out on delivery apps often need to invest in paid in-app promotions. These costs can range from $50 to $500+ per month, depending on the level of visibility desired. Marketing fees are typically deducted automatically, based on the package or marketing option chosen.

At times, platform algorithms offer additional exposure if restaurants choose to participate in a platform-wide promotion. Yet these promotions take a hefty amount out of operators’ budgets with no guaranteed return on investment.

Promotional adjustment: Deductions for platform discount fulfillment, coupons, promotions, or marketing funded by restaurants.

These promotional fees or discounts are often deducted from the payout, but typically go unnoticed by the POS system.

Case in Point

While direct sales typically yield $20-25 profit per $100 in revenue, third-party delivery sales may generate only $7-9 after all platform deductions—representing up to a 64% margin reduction, which may go completely unnoticed. This dramatic difference stems not just from commission fees, but from the accumulation of untracked adjustments, missed refunds, and reconciliation gaps that compound over time without proper oversight.

Solutions

Rescuing Your Profits: How to Reduce Risk & Protect Margins

Implement Careful Menu Pricing

Third-party delivery fees can eat away as much as 64% of profits compared to direct sales. To compensate, many restaurants raise prices on delivery apps by 15–30% over in-store prices. One owner explains: “DoorDash charges me over 20%, so I do a 15% markup. Same for GrubHub. UberEats is still ~30%, so it gets a 20% increase.” Smart menu pricing helps protect margins without alienating in-store customers.

Solve Problems Pre-Emptively

Accuracy errors are costly— most customers don’t reorder after a missing product mistake. Restaurants can prevent this by tracking error patterns, creating double-check points for accuracy, and training staff to catch mistakes before orders leave the kitchen. By identifying recurring problems early, operators reduce refund losses and protect customer loyalty.

Use Trusted Automated Reconciliation Partners

Driven by these inefficiencies, lost revenue, and the need to adjust business practices for delivery platform operations, restaurants are turning to automation. In 2024, 43% of operators had already adopted or were planning to adopt automated reconciliation systems, and 38% reported higher profits as a result (Future of Automation Report). While manual reconciliation might be feasible for single locations, automated solutions are more scalable for multi-location businesses, while accelerating reconciliation, reducing errors, and improving financial visibility and control.

Reconciliation Success

Otter's financial reconciliation feature helped approximately 300 McDonald's stores decrease their reported billable sales by over $5 million over a span of just six months, resulting in savings of over $500,000 in taxes and fees.

Dispute Management:

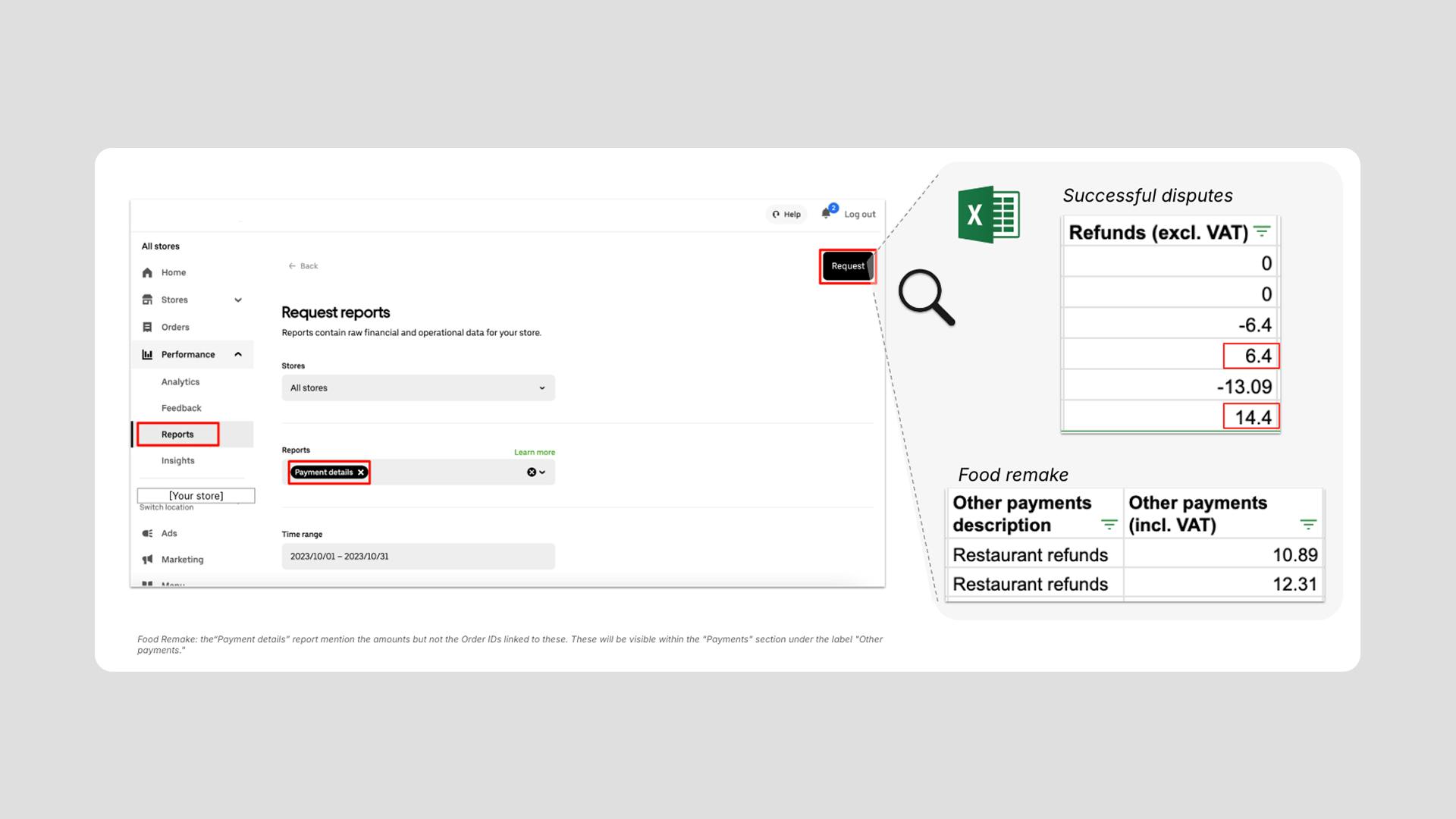

Don’t leave money on the table. Most platforms have a 30-day window for disputing adjustments, chargebacks, or questionable fees. Merchants can use built-in dispute systems or external services like Otter’s Revenue Recapture, which handles claims on behalf of restaurants and recovers lost funds at scale. Even if unsure of the accuracy of the dispute, restaurant owners/operators should raise tickets for any unpaid orders.

Implement Fee-Tracking Processes At A Regular Cadence

Assume your POS data is inaccurate until proven otherwise. The best practice is to reconcile orders every 15 days, and certainly before reporting taxes or submitting sales. Set up a comprehensive system to track all platform-related costs: commissions, processing fees, cancellations, promotional deductions, and marketing spend. Run comparisons weekly, monthly, or quarterly, and raise tickets for unpaid orders. Manual tracking may work for single locations, but larger chains need accountants or dedicated platform partners to calculate true profitability.

The Winners

Restaurant operators who use digital tools and optimize operations will stay ahead.

How Market Leaders Choose the Right Reconciliation Partners

Reconciliation Success

Best-in-class operators deploy unified tools that pull, match, and reconcile data from every partner, so nothing falls through the cracks.

What Restaurant Leaders Look For In Capabilities

Order-level detail

Instead of providing only an overview of the numeric discrepancies lumped into a sum, they provide specific transaction data to identify the types of errors or adjustments. This helps ensure that every fee and transaction is accounted for.

Dispute and Reconciliation Offerings

Identifying errors and adjustments is one step; recovering the money is another. Best-in-class tools support both. Tools like Otter offer services to take the frustrating process of transaction disputes off your plate. (See: Otter Revenue Recapture)

Expertise Over Generic Tools

General bookkeeping software or accountants often miss industry-specific issues. The strongest solutions are built for restaurants, with years of operational expertise behind them. Look for platforms and partners which specialize in the industry, have years of experience behind them, and offer services specific to your type of business.

Platform Security

Because reconciliation involves sensitive financial data, SOC II compliance is essential. It ensures strict customer data protection and process integrity, so that operators can trust the system that’s handling their revenue. Ensure SOC II compliance

Any solution you adopt must meet strict SOC II compliance standards to safeguard sensitive customer data. Platforms like Otter provide security protocols and stringent controls to protect both restaurant and consumer information.

What Strong Solutions Deliver

- Detect — Pinpoint mismatches between POS, and platforms,

- Reconcile — Match every order, payout, and adjustment across channels

- Consolidate — Auto-generate clean, reconciled files ready for import into financial systems, tax reporting, or royalty reporting

The goal: fewer manual errors, faster dispute resolution, more efficient resource use, and a clear view of the true financial reality for reporting.

Conclusion

Hot Take

“It’s relatively simple– your POS is wrong. I don’t know a single POS system that’s accurate. I haven’t yet seen a POS that captures refund data. So if you’re using that data to report your taxes you’re reporting them wrong.” -Robert Graham, Otter Innovations

In today’s delivery-driven marketplace, restaurants face an unavoidable truth: sales growth does not automatically translate into profit growth. The hidden world of fees, delayed adjustments, and POS inaccuracies quietly erodes margins and exposes operators to unnecessary tax and royalty costs. Left unchecked, these leaks can mean the difference between a thriving business and one that is constantly chasing profitability.

The good news is that operators are not powerless. By embracing proactive strategies—smart menu pricing, consistent error tracking, dispute management, and above all, automated reconciliation—restaurants can reclaim lost revenue and regain control over their financial reality. Industry leaders are proving that profitability in delivery is possible, but only when reconciliation is treated as a core business process, not an afterthought.

Restaurants winning in 2025 will be relentless in margin protection—not by working harder, but smarter. Automated controls and dispute resolution, along with preventative measures and routine data reviews keep the business ahead, even as delivery complexity accelerates. Rescuing profits entails working with the right processes built for the unique complexity of food delivery. With the right systems in place, restaurants can turn reconciliation from a painful burden into a competitive advantage– transforming delivery from a source of hidden costs into a channel of sustainable, profitable growth.

Otter has years of specialized expertise in reconciliation and revenue recovery, helping restaurants turn complexity into clarity. For more information on how to protect your margins and reclaim lost revenue, visit tryotter.com, or connect with our team at [email protected].